Cash on Delivery (COD) has been a go-to payment option for many shoppers, especially in regions where digital payment systems are still evolving. But as a Shopify merchant, if you’re offering COD, you’re likely already aware of its inherent challenges: high costs, delayed payments, and a risk of RTO (Return to Origin).

One way to mitigate these costs is by charging a COD fee. However, the big question is:

How do you implement COD fees without alienating your customers?

Let’s break down how you can introduce COD fees the right way—without driving customers away.

The Problem with Free COD

Offering COD for free might seem like a way to attract more customers, but it often leads to problems that harm your business in the long run:

- 🏷️ Increased RTOs – Free COD invites high-risk orders that are more likely to be returned.

- 💰 Cash Flow Delays – You’ll face delays in receiving the actual payment, as you have to wait for the order to be delivered and paid for.

- 📦 Additional Handling Costs – COD orders often require more processing and can result in higher operational expenses.

So, while it seems like a customer-friendly option, free COD can cost you more than you think.

Why Charging a COD Fee Makes Sense

Introducing a COD fee is a practical way to offset these costs while still offering the payment method your customers want. Here’s why it works:

1. It Helps Cover Additional Costs

COD comes with hidden expenses, such as return shipping, manual reconciliation, and handling. Charging a small fee (₹30–₹60) helps you recover these costs without impacting your margins.

2. It Filters Out Non-Serious Buyers

By introducing a nominal fee, you reduce the number of fake or non-committed orders. Customers who are genuinely interested in purchasing will still proceed with the order, while those who are not will reconsider.

3. It Encourages Prepaid Payments

Once customers see a COD fee, they may opt for alternative, prepaid payment methods like UPI, card payments, or net banking to avoid the extra charge. This helps you reduce cash flow issues and simplifies your operations.

Best Practices for Introducing COD Fees Without Losing Customers

While a COD fee is a smart move, the way you introduce it matters. Here are some best practices to implement COD fees without alienating your customers:

1. Be Transparent from the Start

Transparency is key. Clearly display the COD fee on the checkout page, ideally before the customer proceeds to the final step of placing an order. This reduces any surprise charges at the last minute and helps customers make informed decisions.

Tip: Add a small note explaining why the COD fee exists—”This fee helps cover delivery and handling costs.”

2. Offer an Incentive for Prepaid Payments

To reduce the reliance on COD, offer incentives for customers who opt for prepaid methods. For example:

- Offer a small discount on prepaid orders.

- Promote faster shipping or priority processing for prepaid orders.

This not only encourages customers to choose a more efficient payment method, but it also ensures you get paid sooner.

3. Charge a Nominal Fee—Don’t Overdo It

The key is not to discourage customers with an excessive charge. Keep the fee minimal—₹30–₹60 is usually a sweet spot. This amount is enough to cover your extra costs without scaring off customers who still want the COD option.

4. Use Dynamic Fees Based on Location or Cart Value

Consider adjusting your COD fees based on the customer’s location (e.g., higher COD fees for remote or high-risk areas) or the total cart value (e.g., a higher COD fee for large, bulk orders). This customization can help balance out costs effectively.

5. Offer COD with Certain Restrictions

Not all customers should be offered COD, especially if you’ve had past issues with certain customers or regions. Use customer tags, pincode-based restrictions, or order value filters to ensure that COD is offered only to customers who are likely to complete their purchase.

Tip: With tools like Nex Advanced Cash on Delivery, you can easily create these rules in Shopify.

How to Set Up a COD Fee on Shopify

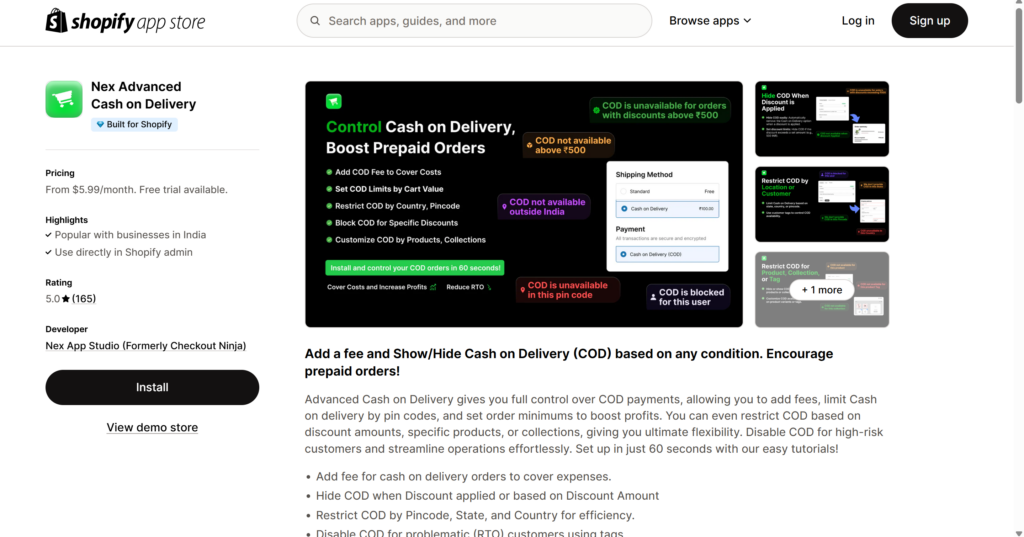

While Shopify doesn’t offer built-in support for COD fees, you can implement them easily with the Nex Advanced Cash on Delivery App.

Steps:

- Install the App – Search for Nex Advanced Cash on Delivery in the Shopify App Store and click Install.

2. Access the App in Your Admin

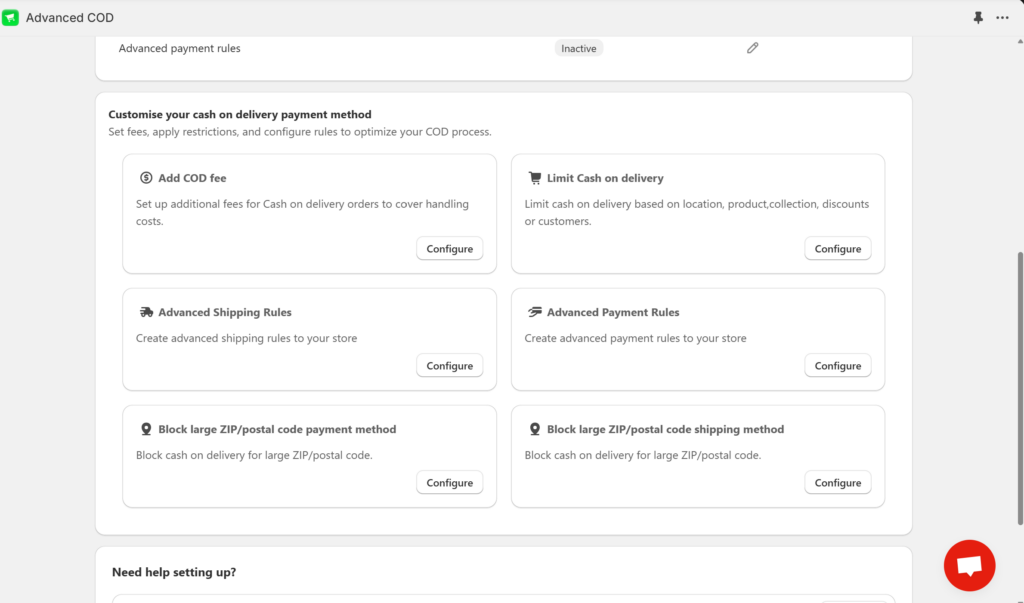

In your Shopify dashboard, go to Apps → Nex Advanced Cash on Delivery App.

3: Create a New Rule

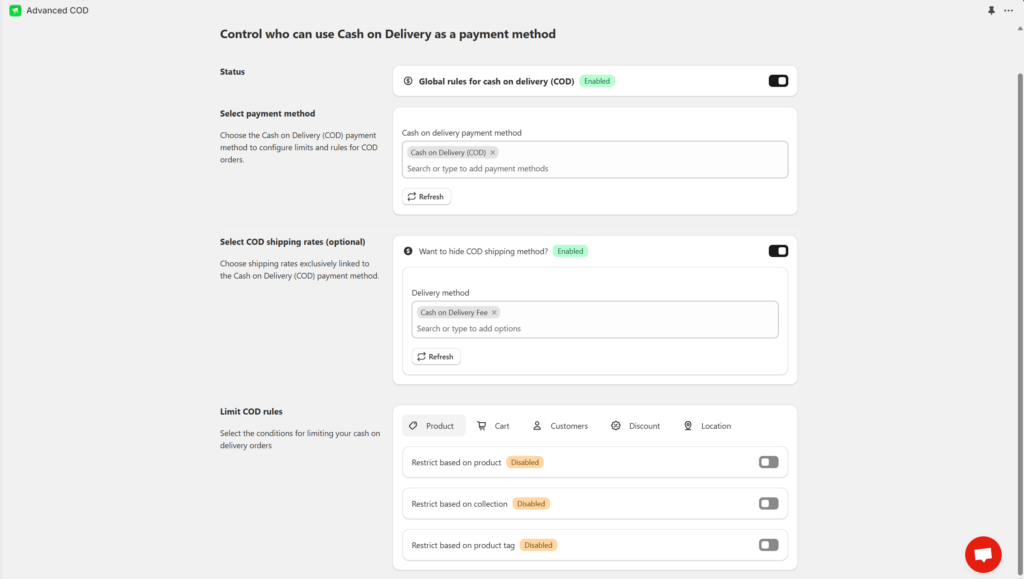

Click on Limit Cash on Delivery Configure , then choose Cash on delivery as the payment method.

You’ll now have access to conditions like:

- Cart value

- Country

- State

- Pincode

- Product tag or collection

You can also set:

- Fixed COD fee

- Minimum order requirement

- Allowed/blocked pincodes

4. Test the Setup – Place a few test orders to ensure the fee is applied correctly at checkout.

Conclusion: Charging COD Fees Can Be a Win-Win

Charging a COD fee doesn’t have to be a deterrent for customers. By being transparent, offering incentives for prepaid orders, and charging a reasonable fee, you can maintain a customer-friendly approach while protecting your business from the inherent risks of COD.

The key is to balance your costs and customer satisfaction. With the right strategy, you can offer COD and still keep your margins intact.

👉 Install Nex Advanced Cash on Delivery today

and start implementing smarter, more effective COD fees for your Shopify store.

What’s the Best Way to Handle COD Fees Without Losing Customers?